|

|

|

|

|

Long Term Care

Long Term Care

Long Term Care can help meet health and personal needs while reducing the financial strain that could be put on your budget and investments.

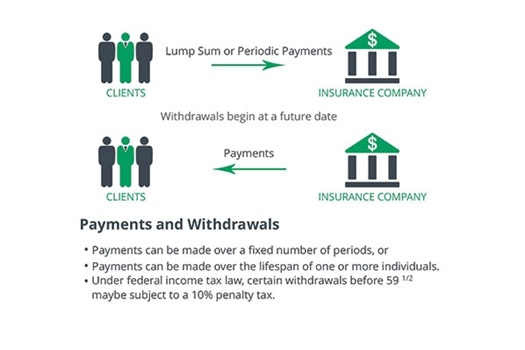

How Deferred Annuity Works

A deferred annuity is a type of annuity contract that delays income, installment or lump-sum payments until the investor elects to receive them. This type of annuity has two main phases: the savings phase, which is when you invest money into the account, and the income phase, which is when the plan is converted into an annuity begins paying the account owner. A deferred annuity can be variable or fixed.

**Fixed and Variable annuities are suitable for long-term investing, such as retirement investing. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 ½ are subject to a 10% IRS penalty tax and surrender charges may apply. Variable annuities are subject to market risk and may lose value.